Verifying New Employees on Form I-9

Newly hired employees must complete Form I-9 Employment Eligibility Verification, regardless of whether they are assigned to a federal contract. Employers must comply with Form I-9 procedures found in the M-274 Handbook for Employers, Guidance for Completing Form I-9. E-Verify employers also have additional employment verification requirements for Form I-9 that other employers do not have:

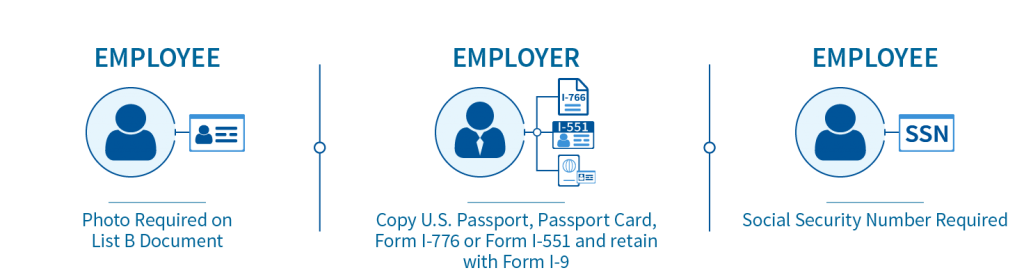

- If an employee chooses to present a List B document, the employer may only accept a List B document that contains a photo (if the employee cannot provide such a document because of religious objections, contact the E-Verify Contact Center at 888-464-4218).

- If an employee chooses to present an Employment Authorization Document (Form I-766), Permanent Resident Card (Form I-551) or U.S. Passport or Passport Card, the employer must make a copy of the document and retain it with the employee’s Form I-9.

- Employees must have a Social Security number (SSN) to be verified using E-Verify. If an employee has applied for but has not yet received his or her Social Security number (i.e., if he or she is a newly arrived immigrant), make a note on the employee’s Form I-9 and set it aside. The employee should be allowed to continue to work. As soon as the Social Security number is available, the employer can create a case in E-Verify using the employee’s Social Security number.

Verifying Existing Employees Using Form I-9

In order to comply with the Federal Acquisition Regulation (FAR) rule, a federal contractor must verify all new hires and existing employees assigned to the federal contract. Federal contractors may also opt to verify their entire workforce with E-Verify. When the employer chooses this option, the employer must decide how to verify its employees by completing three steps.

-

Step 1

Decide which employees the employer wants to verify.

-

Step 2

Determine which existing employees are exempt or have special requirements relating to the verification process.

-

Step 3

Complete new Forms I-9 or update existing Forms I-9.

Related Resources

Supplemental Guide for Federal Contractors

This E-Verify Supplemental Guide instructs federal contractors on the process for verifying employees through the E-Verify system. The E-Verify language in the regulation took effect on September 8, 2009.

M-274, Handbook for Employers

The guidance in this handbook, in tandem with the Form I-9 instructions, helps employers properly complete Form I-9, which assists in verifying that your employees are authorized to work in the United States.

Related Upcoming Webinars

E-Verify for Federal Contractors

Learn about timelines for enrollment, how to use the program, how to verify new and existing employees, and exemption and exceptions for federal contractors who have been awarded a federal contract with the FAR E-Verify clause. This webinar, useful for federal contractors and subcontractors affected by the E-Verify federal contractor rule, is eligible for 1 professional development credit through SHRM and HRCI.

Estimated duration: 1 hour.

![]()

![]()