Starting July 15, 2022, employees whose E-Verify cases are referred to SSA on or after July 15, 2022, will have the normal 8 federal working days to contact their local SSA office to begin resolving the mismatch. At the onset of the COVID-19 Pandemic in March 2020, E-Verify extended the timeframe for an employee to take action to resolve a Social Security (SSA) Tentative Nonconfirmation (mismatch). E-Verify cases referred on or after July 15, 2022, E-Verify will no longer provide extended timeframes for employees to visit SSA to resolve these mismatches. E-Verify cases referred between March 2, 2020 to July 14, 2022, with a SSA mismatch will still have an extended timeframe to be resolved, as explained below.

Check E-Verify regularly for updated case alerts.

Cases must be referred in E-Verify within 10 federal government working days after the issuance of the mismatch. Employees with any mismatch referred on or after July 15, 2022 must take action to resolve it within 8 federal working days after the case is referred. Federal business days are Monday through Friday and do not include federal holidays.

You may not take any adverse action against an employee because the mismatch is in an interim case status.

Employees with an SSA mismatch referred between March 2, 2020 to July 14, 2022, have until September 29, 2023 to resolve it.

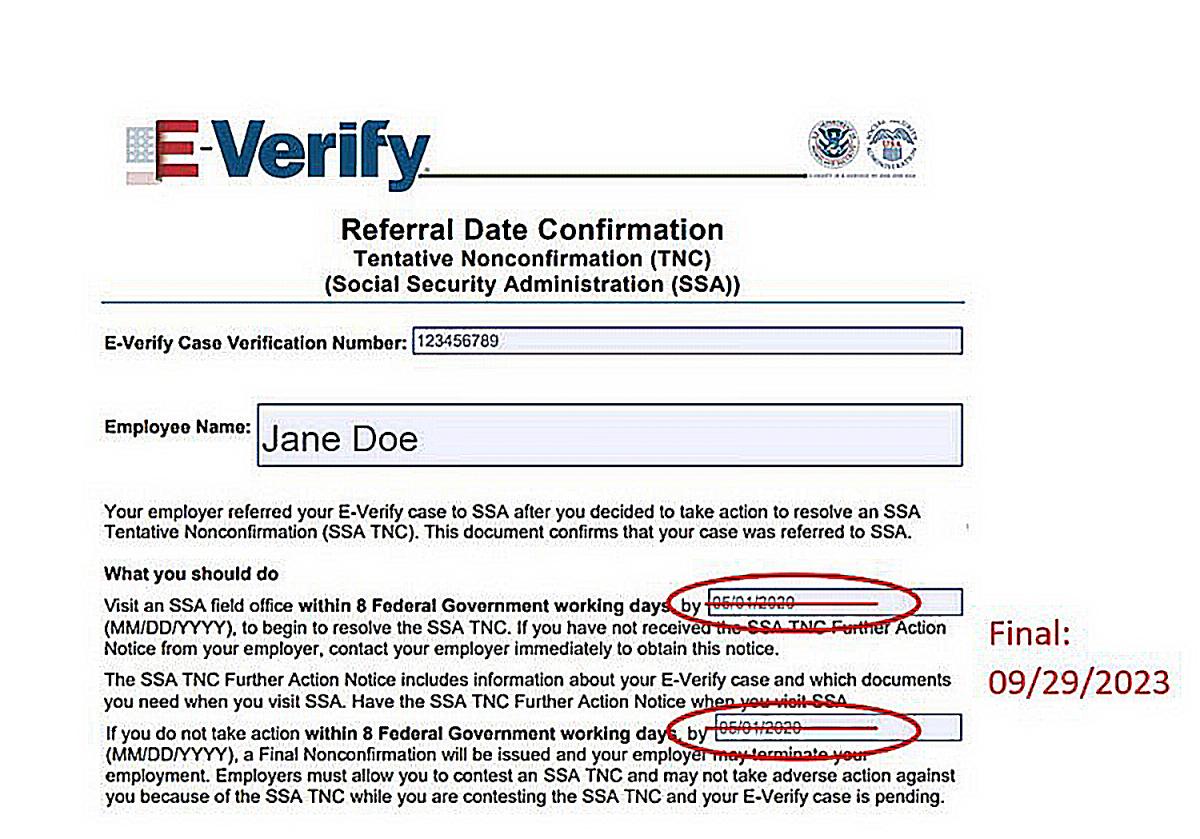

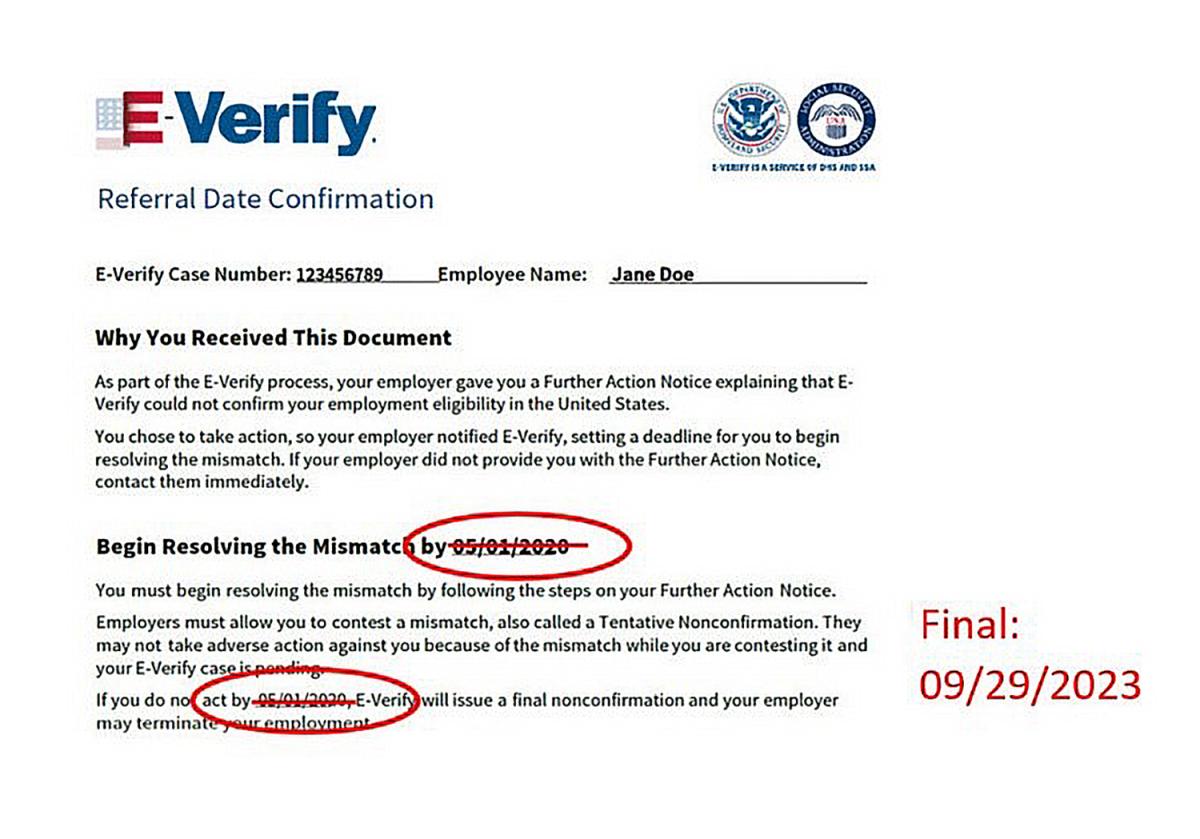

- Review the date on your employee’s original Referral Date Confirmation (RDC). See the RDC samples below for reference.

- After you find the date on the original RDC, see the chart below for preferred dates your employee should visit SSA to resolve their mismatch.

*Note: Although the timeframes are preferred, all employees must visit SSA to resolve their mismatch by the final deadline of September 29, 2023, or their case will automatically get a Final Nonconfirmation (FNC).If the date on the employee’s Referral Date Confirmation is: Then you should contact SSA between: March 2 to December 31, 2020 October 1 to December 31, 2022 January 1 to December 31, 2021 January 1 to March 31, 2023 January 1 to July 14, 2022 April 1 to June 30, 2023 - Update the RDC with the final date by printing a new ‘Referral Date Confirmation’ notice. This will have the final deadline for employees to contact SSA to begin resolving their Mismatch. To reprint a copy of your employee’s “Referral Date Confirmation” log-in to E-Verify, select your employee’s case and select the “Print Confirmation” button. You may also choose to update the existing RDC by which your employee must visit SSA by crossing out each date and inserting “Final: 09/29/2023.”

Sample Referral Date Confirmation Notices

Sample 1 Sample 2

Sample 1 is the historical version of the Referral Date Confirmation letter printed prior to May 25, 2022.

Sample 2 is the current version of the Referral Date Confirmation letter. - Communicate to your employee the preferred dates to visit SSA to resolve their mismatch. You may also make a note of the preferred dates on the RDC.

- Provide a copy of the updated RDC to your employee via email or hard copy. If you need to reprint a copy of your employee’s RDC, login to E-Verify, select your employee’s case, and select the “Print Confirmation” button.

To complete the E-Verify process, employers must close every case, including cases that were recently updated with final responses. However, E-Verify will automatically close cases that receive a result of Employment Authorized.

Please refer to the E-Verify User Manual Section 4.1 for assistance and additional guidance on closing cases.

More information on the Tentative Nonconfirmation (mismatch) process can be found in the E-Verify User Manual or on our website at Tentative Nonconfirmations (Mismatch) page. SSA offices are currently experiencing high customer volumes, and E-Verify recommends that employees visit https://www.ssa.gov/locator/ to confirm office hours and availability.

If your E-Verify case resulted in a Social Security Administration (SSA) Tentative Nonconfirmation (mismatch) and the date on your original Referral Date Confirmation (RDC) is:

- On or after July 15, 2022, you must contact a local SSA field office by the date on your RDC to resolve your mismatch.

- Between March 2, 2020, and July 14, 2022, E-Verify granted you extended time, until September 29, 2023, to take action to resolve your mismatch. Your employer should update your RDC with the final date of September 29, 2023 and may provide the notice to you via email or hard copy. Please refer to your RDC and information below for specifics on how to resolve your mismatch.

If you have not received the RDC from your employer, contact your employer to obtain it. You may also refer to your Further Action Notice (FAN) which includes information about your E-Verify case, and documents needed for visiting SSA.

For your convenience and to ensure SSA can assist with your E-Verify case, we suggest you resolve your mismatch during the following timeframes:

| If the date on the employee’s Referral Date Confirmation is: | Then you should contact SSA between: |

|---|---|

| March 2 to December 31, 2020 | October 1 to December 31, 2022 |

| January 1 to December 31, 2021 | January 1 to March 31, 2023 |

| January 1 to July 14, 2022 | April 1 to June 30, 2023 |

*Note: Although the timeframes are preferred, you must visit SSA to resolve your mismatch by the final deadline of September 29, 2023, or E-Verify will issue a Final Nonconfirmation and your employer may terminate your employment.

Employers must allow you to take action to resolve a mismatch and may not take adverse action against you because of the mismatch while your E-Verify case is pending.

E-Verify recommends that you visit https://www.ssa.gov/locator/ to confirm office hours and availability. You may experience long lines and may need to wait outside because space inside SSA offices may be limited. Please plan accordingly.

If you do not take action by September 29, 2023, E-Verify will issue a Final Nonconfirmation and your employer may terminate your employment.

For more information about resolving your mismatch, please refer to E-Verify’s employee page.Related Resources

E-Verify User Manual

This manual provides guidance on E-Verify processes and outlines the rules and responsibilities for employers and E-Verify employer agents enrolled in E-Verify. Users must follow the guidelines set forth in the E-Verify Memorandum of Understanding for Employers (MOU) and the rules and responsibilities outlined in this manual.